Learn Exactly How Succentrix Business Advisors Enhance Operational Effectiveness

Learn Exactly How Succentrix Business Advisors Enhance Operational Effectiveness

Blog Article

The Advantages of Hiring a Professional Company Audit Consultant

Engaging an expert organization accounting advisor can be a transformative decision for any type of company. What details strategies can these advisors execute to tailor monetary options that straighten with your organization goals?

Know-how in Financial Monitoring

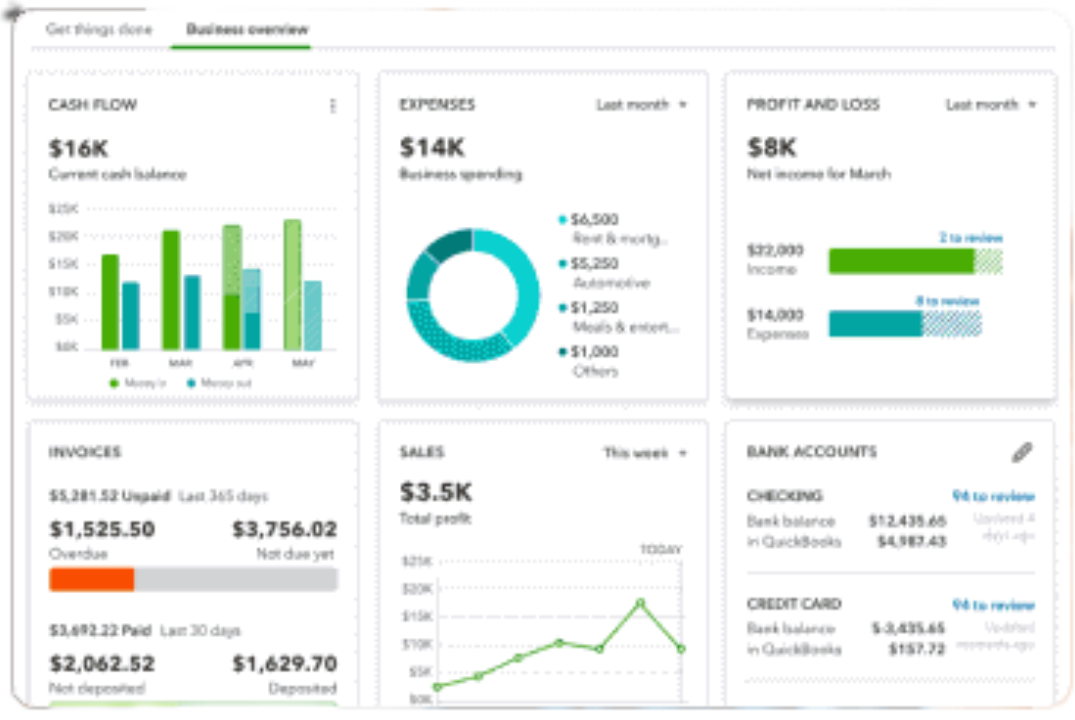

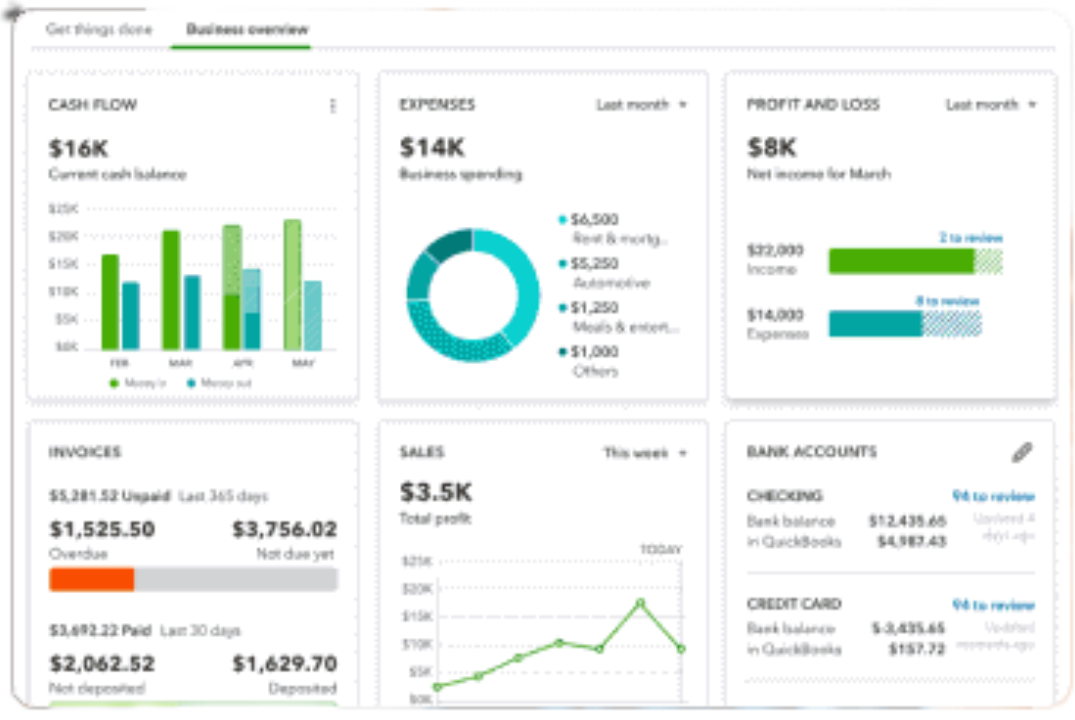

In addition, a knowledgeable expert can carry out durable bookkeeping systems that offer accurate and prompt financial details. This precision is important for keeping track of efficiency and making educated choices. By leveraging their knowledge, businesses can boost their monetary literacy, enabling them to analyze monetary records and comprehend the implications of numerous monetary strategies.

Moreover, the consultant's insight right into regulatory conformity guarantees that organizations stick to financial regulations and requirements, reducing the danger of costly charges. They also play a crucial function in tax obligation planning, aiding to lessen liabilities and make best use of cost savings. Inevitably, the tactical support and monetary acumen provided by an expert organization bookkeeping expert empower organizations to attain sustainable growth and keep a competitive side in their respective markets.

Time Financial Savings and Efficiency

Lots of companies locate that partnering with a professional company audit advisor results in considerable time savings and boosted operational effectiveness. By delegating monetary duties to an expert, firms can redirect their focus toward core tasks that drive development and innovation. This delegation of tasks enables local business owner and managers to focus on critical initiatives rather than obtaining stalled by everyday accounting functions.

Expert consultants bring structured processes and progressed software application solutions to the table, dramatically minimizing the moment invested in bookkeeping, tax prep work, and conformity. They are adept at recognizing inefficiencies and applying ideal techniques that not just save time but also minimize the threat of mistakes. Moreover, their expertise ensures that target dates are satisfied regularly, avoiding last-minute shuffles that can impede efficiency.

With a specialist bookkeeping advisor taking care of economic issues, organizations can stay clear of the stress and anxiety of keeping exact documents and navigating intricate regulations. This performance cultivates an extra well organized and aggressive strategy to financial administration, ultimately adding to better source allocation and enhanced overall performance. Succentrix Business Advisors. In this means, employing an accounting consultant not just saves time yet likewise boosts the effectiveness of organization operations

Strategic Preparation and Insights

A professional service accounting consultant plays a critical role in calculated preparation by supplying valuable understandings stemmed from detailed economic analysis. Their proficiency makes it possible for businesses to comprehend their economic landscape, determine development chances, and make educated decisions that straighten with their lasting goals.

In addition, accounting consultants can aid in circumstance preparation, assessing prospective outcomes of different strategic initiatives. This foresight outfits magnate with the expertise to browse uncertainties and utilize on desirable problems. By incorporating financial data into the tactical planning process, consultants equip organizations to craft durable company versions that improve competitiveness.

Inevitably, the cooperation with a professional audit consultant not just raises the strategic preparation process however also cultivates a culture of data-driven decision-making, placing services for sustained success in a significantly dynamic marketplace.

Conformity and Danger Reduction

Compliance with economic policies and effective danger mitigation are crucial for businesses intending to keep functional integrity and secure their possessions. Working with a professional service accounting consultant can considerably boost a company's capacity to browse the complex landscape of monetary conformity. These advisors are skilled in the most up to date regulatory demands, making certain that the business sticks to regional, state, and federal legislations, hence reducing the threat of legal difficulties or costly penalties.

Furthermore, a specialist consultant can recognize prospective dangers connected with monetary practices and advise strategies to mitigate them. This aggressive strategy not just secures the service from unanticipated obligations however also fosters a society of responsibility and transparency. By on a regular basis carrying out audits and evaluations, they can uncover susceptabilities in monetary processes and implement controls to resolve them properly.

Along with compliance and threat administration, these consultants can offer valuable understandings into best techniques that line up with market criteria. As guidelines remain to advance, having a specialized bookkeeping specialist guarantees that businesses continue to be responsive and agile, permitting them to focus on development and development while guarding their monetary wellness.

Personalized Financial Solutions

Just how can businesses optimize their monetary methods to fulfill unique operational requirements? The response exists in employing a professional service audit expert that specializes in customized monetary options. These specialists analyze the details challenges and goals of a business, enabling them more to develop tailored techniques that line up with the company's vision.

Custom-made economic remedies incorporate a vast array of solutions, consisting of capital administration, tax obligation budgeting, forecasting, and planning. By analyzing current financial data and market conditions, advisors can create bespoke plans that make the most of earnings while decreasing dangers. This customized strategy makes sure that businesses are not merely complying with common monetary methods however are instead leveraging approaches that are especially developed to support their functional dynamics.

Furthermore, tailored services enable adaptability; as company needs progress, so too can the economic methods. Succentrix Business Advisors. Advisors can frequently review and change plans to mirror changes in the marketplace, regulative environment, or firm objectives. Inevitably, the assistance of a specialist bookkeeping expert allows organizations to navigate intricacies with confidence, making certain sustainable development and financial health and wellness customized to their distinctive needs

Final Thought

In final thought, the advantages of employing an expert organization audit advisor are complex and extensive. Their effectiveness in conformity and threat reduction further safeguards companies from regulative challenges while maximizing tax obligation commitments.

A specialist organization audit advisor brings a wide range of knowledge in financial analysis, budgeting, and tactical planning, which are vital parts for audio financial decision-making. By leveraging their know-how, organizations can directory boost their economic proficiency, enabling them to interpret economic records and understand the implications of numerous monetary strategies.

Inevitably, the calculated assistance and financial acumen supplied by an expert business audit consultant empower companies to achieve lasting growth and keep an affordable edge in their corresponding markets.

Many organizations discover that partnering with a professional organization bookkeeping expert leads to considerable time savings and boosted operational performance. Eventually, the advice of an expert accounting consultant makes it possible for services to browse complexities with self-confidence, guaranteeing lasting growth and monetary wellness tailored to why not look here their distinct requirements.

Report this page